Cash Balance

1.Review or make changes to any cash balance details.

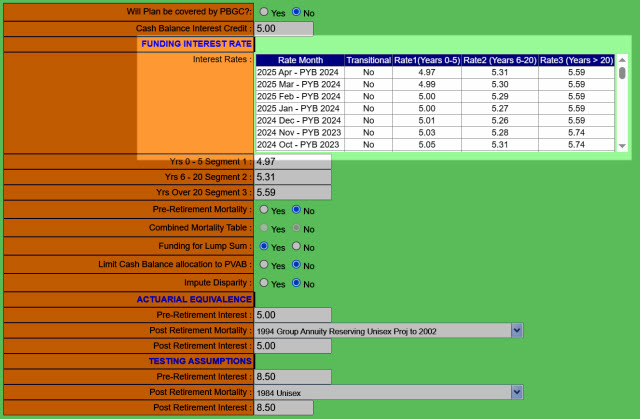

2.In Funding Interest Rate, double-click a line from the monthly interest rates table to choose a group of segment rates. You can also enter segment rates manually below the table.

3.You must click on the ![]() button to apply changes before leaving the page.

button to apply changes before leaving the page.

Will Plan be covered by PBGC:

This is an option if the Plan will be covered by PBGC (Pension Benefit Guaranty Corporation).

Cash Balance Interest Credit:

This is the cash balance credit interest to be used in the Plan.

FUNDING INTEREST RATE

Interest Rates: This is the table that shows the monthly values for the average segment rates.

This is the interest rate used for Rate 1 (Years 0-5).

Yrs 6-20 Segment 2:

This is the interest rate used for Rate 2 (Years 6-20).

Yrs Over 20 Segment 3:

This is the interest rate used for Rate 3 (Years > 20).

Pre-Retirement Mortality:

This option allows you to use the pre-retirement mortality computation.

Combined Mortality Table:

This option is used if you wish to combined mortality table computation.

Note that this option becomes disabled and defaulted to "No" when the Plan Effective Year is 2024 and beyond.

Funding for Lump Sum:

This option allows you to use the funding for lump sum.

Limit Cash Balance allocation to PVAB:

This option allows you to limit the Cash Balance allocation to PVAB (Present Value Accrued Benefit).

Impute Disparity:

This option is used if you wish to impute permitted disparity.

ACTURIAL EQUIVALENCE

Pre-Retirement Interest:

This is an interest rate to project a current year contribution to retirement age (testing age). The current regulations stipulate using 7.5% to 8.5% as the allowable interest rate range.

Post Retirement Mortality:

Choose a mortality table, which combined with the Post-Retirement Interest Rate, will determine the Annuity Purchase Rate (APR). The APR converts the projected contribution into a benefit in order to test the plan under the 401(a)(4) regulations.

Post Retirement Interest:

This is an interest rate that will be used with the selected mortality table. The rate must between 7.5% to 8.5%.

TESTING ASSUMPTIONS

Pre-Retirement Interest:

This is an interest rate to project a current year contribution to retirement age (testing age). The current regulations stipulate using 7.5% to 8.5% as the allowable interest rate range.

Post Retirement Mortality:

Choose a mortality table, which combined with the Post-Retirement Interest Rate, will determine the Annuity Purchase Rate (APR). The APR converts the projected contribution into a benefit in order to test the plan under the 401(a)(4) regulations.

Post Retirement Interest:

This is an interest rate that will be used with the selected mortality table. The rate must between 7.5% to 8.5%.