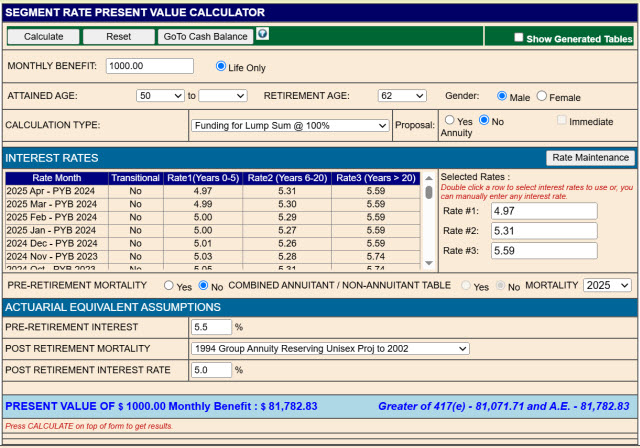

Segment Rate Present Value Calculator

The opening screen has the following default entries. Whenever you click on ![]() button it will go back to this screen.

button it will go back to this screen.

Currently, the only available option is Life Only annuities and only rounded ages are accepted.