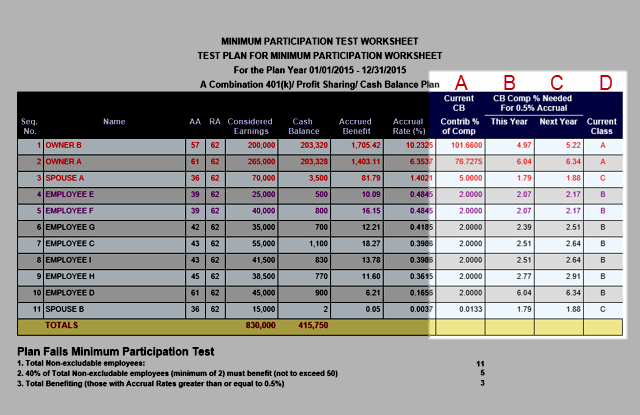

Four columns have been added to the Minimum Participation Test Result Report:

Column A - Participants' current Cash Balance contributions as a result of Class designation or individual override.

Column B - Change the individual or Class contribution to this percentage to reach 0.5% accrual rate for this year.

Column C - Change the individual or Class contribution to this percentage to ensure 0.5% accrual rate for this plan year as well as following year.

Column D - Remember that a participant's contribution may be individually overridden on the Census screen despite the class designation. The census override always trumps the class contribution.

The Plan above fails the test. To pass, it needs 2 or more participants with accrual rate of 0.5% or better.

Solution 1 - Change Class B Cash Balance contribution from 2% to at least 2.07. This will bring in Employees E & F. You may also just want to put E & F in a new class with the higher contributions so everyone else stays at 2.00%. Or, you can go to the Census Cash Balance Override.

Solution 2 - Maybe you want to bring in Spouse B and Employee C (the manager) by giving them a contribution higher than column B or C.

Notes: Why are we showing Column C? If the demographics do not change, the amount needed for a 0.5% accrual rate will increase because of the increase in age. Therefore, when defining your cash balance contribution, you should give it some allowance.

|