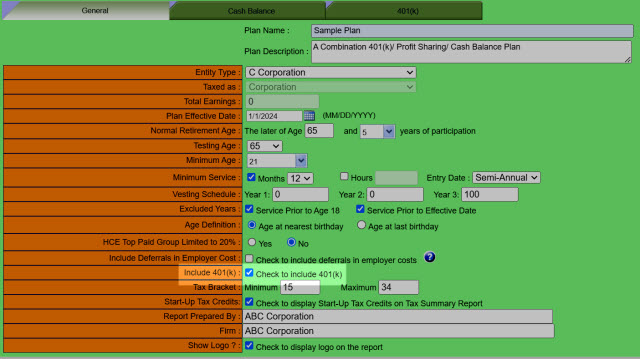

General

1.Review or make changes to any general plan details.

2.Un-check the "Check to include 401(k)" option if the plan is Cash Balance only. This will disable the 401(k) tab.

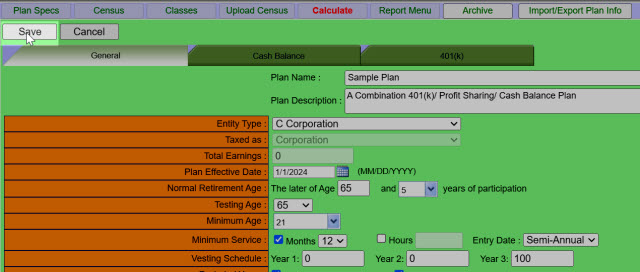

3.You must click on the ![]() button to apply changes before leaving the page.

button to apply changes before leaving the page.

The Company's Name can be as long as 75 characters.

The Company's Plan Description.

Entity Type:

The Entity Type of the plan.

Taxed as:

Your client is either taxed as a Corporation wherein all employees including owners (stockholders) are paid wages that are reported on W-2s or as an unincorporated business wherein all owners have Schedule C or K-1 incomes.

Total Earnings:

The Total Earnings is allocated amongst the Partners based on the ratio of each Partners Ownership Percentage to the Total Ownership Percentage.

The Plan Effective Date is always the beginning of the Plan Year. Ages are calculated as of this date. However, all contributions are determined as of the end of the Plan Year. Unless you want the Plan to be effective next year, you should use '01/01/2010'.

The new law allows a normal retirement age as early as age 62 with no actuarial reduction to the current pension dollar limit of $160,000/yr ($13,333/mo.). The calculator will always use the retirement age you entered but it will not allow any participant to retire less than 5 years from entry date. For example, if a participant is already 58 and the Normal Retirement Age you entered is 62, his retirement age will be 63. NRA should never exceed 65. This Retirement Age is for Defined Benefit Plans only.

Testing Age:

This field is used for Non-Discrimination testing if the 401(k)/PS Retirement Age is greater than the Retirement Age for the Cash Balance plan. It can never be less than the Retirement Age.

Minimum Age:

This is the age required to be a participant in the plan. If minimum age is 21, then entry date is assumed to be the 1st day of the Plan Year or 6 months later after age 21 is attained; otherwise, entry date is assumed to be the 1st day of the Plan Year following attainment of minimum age.

Minimum Service:

This is the service required to be a participant in the plan. If minimum service is 12 months, then entry date is assumed to be the 1st day of the Plan Year or 6 months later after completion of 12 months of service; otherwise, entry date is assumed to be the 1st day of the Plan Year following completion of minimum service.

Vesting Schedule:

This represents the non-forfeitable interest of participants in their account balances under a defined contribution plan or accrued benefits under a defined benefit plan and is directly related to an employee's length of service with the employer.

Excluded Years:

The following years of service may be disregarded for vesting purposes:

1.Service Prior to Age 18

2.Service prior to the Effective date of the Plan

Age Definition:

This is an option to use for age at nearest birthday and age last birthday.

HCE Top Paid Group Limited to 20%:

Has an election been made to limit the number of Highly Compensated Employees to the top 20% of employees ranked by compensation?

This election does not apply to 5% owners who are Highly Compensated regardless of whether they are in the Top Paid Group.

Include Deferrals in Employer Cost:

This is used to include the owners' deferral and catch-up contributions in the Employer Cost calculation.

Include 401(k):

"Check to include 401(k)" option if the plan is Cash Balance only. This will disable the 401(k) tab.

Tax Bracket:

These tax rates are used in the Tax Summary Report to estimate the after tax cost of the plan.

Start-Up Tax Credits:

"Check to display Start-Up Tax Credits on Tax Summary Report" option if you want to show the Start-Up Tax Credits on the Tax Summary Report.

Report Prepared By:

The name of the person who prepared the report.

Firm:

The name of the company.

Show logo?

Check this option to include your report logo to this plan.