Minimum Allocation Gateway Test Worksheet Report

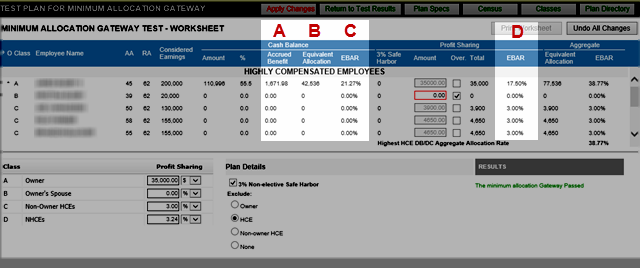

This worksheet allows adjustment of the Profit Sharing contribution and/or the parameters of the Non-elective Safe Harbor contribution in order to pass a failed Minimum Allocation Gateway Test. You can make these adjustments by changing the Profit Sharing Override for any individual or by changing the Profit Sharing allocation for an entire class. To override the Profit Sharing for an individual, first check the override box then enter an amount. To change the Profit Sharing contribution for an entire Class, make adjustments to the amount in the lower-left corner of the worksheet. You can also change the parameters of the Non-elective Safe Harbor contribution by adding or removing the Non-elective Safe Harbor contribution, or by making adjustments to those participants excluded from receiving the Safe Harbor contribution. The Safe Harbor parameters are located under the Plan Details heading.

As soon as a change is made, the Minimum Allocation Gateway test will be re-calculated. When the test is passed and you are satisfied with the results, click on the “Apply Changes” button to finalize the changes.

You may exit the worksheet without saving any of the changes by clicking on the “Return to Test Results” button.

The following is an explanation of the Minimum Allocation Gateway Test and a definition of some of the terms used in the calculations. To satisfy the Minimum Allocation Gateway for an aggregated Cash Balance Plan (DB) with a 401(k) Profit Sharing Plan (DC), each NHCE must have an aggregate normal allocation rate that meets the following requirements:

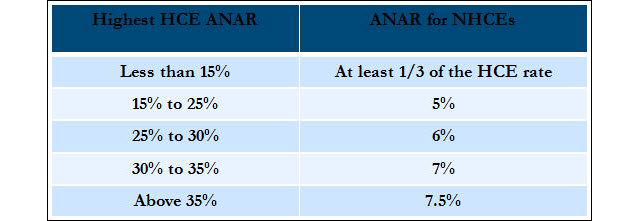

•The minimum DB/DC Allocation Rate for each NHCE must be based on the Highest HCE DB/DC allocation rate calculated, as shown in the following table. (Rounded up to the nearest percent.) |

|

A. The Cash Balance Accrued Benefit is the equivalent of the Cash Balance Contribution expressed as a monthly benefit.

B. The Cash Balance Equivalent Allocation is the Accrued Benefit converted to a lump sum at Retirement using the testing assumptions.

C. The Cash Balance EBAR is the Equivalent Allocation divided by the Considered Earnings.

D. The Profit Sharing EBAR is the sum of the Profit Sharing contribution and the Non-elective Safe Harbor Contribution divided by Considered Earnings.

•Instead of using each NHCE’s equivalent allocation rate under a DB plan in calculating the aggregate allocation rate, it is permissible to use the average of the equivalent allocation rates of all NHCE's benefiting under the DB plan. |

|

Who must receive the minimum allocation gateway? |