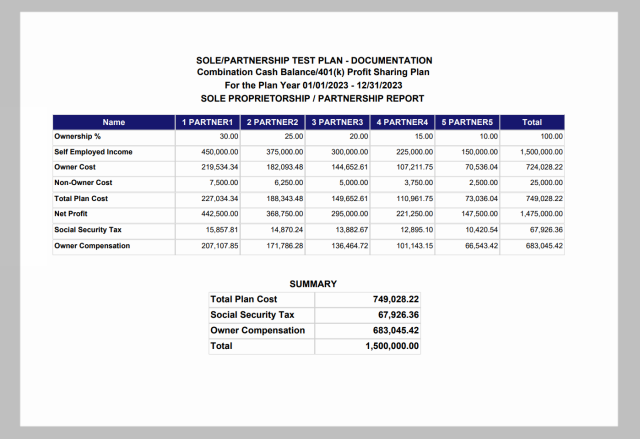

Sole Proprietorship/Partnership Report

The capability to perform a Sole Proprietorship/Partnership calculation has been added to the Cash Balance Proposal System.

The Sole Proprietorship/Partnership calculation divides the total amount of Schedule C income or K1 income between the Employer Contribution, the Social Security Tax and the Owner Compensation.

A Partnership calculation occurs when there are more than one employee with Ownership Percentages.

A Sole Proprietorship calculation occurs when there is only one employee with an Ownership Percentage.

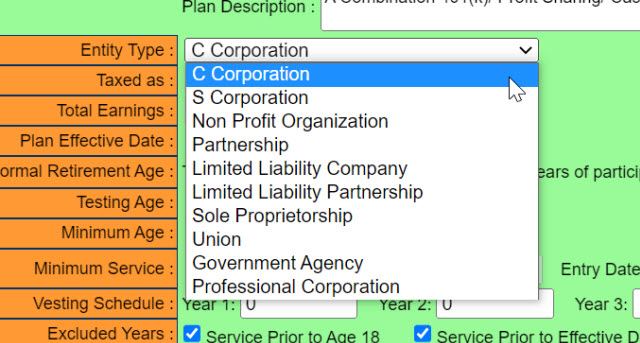

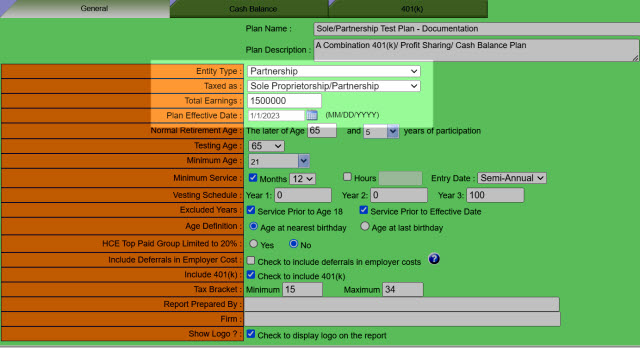

The Sole Proprietorship/Partnership calculation is available for the following Entity Types: Partnership, Limited Liability Company, Limited Liability Partnership, or Sole Proprietorship.

If any of these Entity Types is selected, the option to be taxed as a Sole Proprietorship/Partnership becomes available. Select this option to perform a Sole Proprietorship/Partnership calculation.

Once the option to be taxed as a Sole Proprietorship/Partnership is selected, a Total Earnings field becomes available. Enter the Total Schedule C income or K1 Income for all partners in this field.

The Total Earnings is allocated amongst the Partners based on the ratio of each Partners Ownership Percentage to the Total Ownership Percentage.

For example, if there are five partners with the following Ownership Percentages:

Partner 1 : 30%

Partner 2 : 25%

Partner 3 : 20%

Partner 4 : 15%

Partner 5 : 10%

then Partner 1 would receive 30% of the Total Earnings, Partner 2 would receive 25% of the Total Earnings, Partner 3 would receive 20% of the Total Earnings, Partner 4 would receive 15% of the Total Earnings and Partner 5 would receive 10% of the Total Earnings.

See the chart below showing the allocation of Total Earnings of $1,500,000.

Name |

Partner 1 |

Partner 2 |

Partner 3 |

Partner 4 |

Partner 5 |

Total |

|

Ownership % |

30.00% |

25.00% |

20.00% |

15.00% |

10.00% |

100.00% |

|

Total Earnings |

450,000.00 |

375,000.00 |

300,000.00 |

225,000.00 |

150,000.00 |

1,500,000.00 |

Next the Total Non-Owner Plan Cost is allocated to each partner based on their Ownership Percentage.

The partner's portion of the Total Earnings is reduced by the Partner's share of the Total Non-Owner Cost.

The result is the Net Profit for each Partner.

See the chart below showing the allocation of Total Non-Owner Cost of $25,000.

Total Earnings |

450,000.00 |

375,000.00 |

300,000.00 |

225,000.00 |

150,000.00 |

1,500,000.00 |

|

Non-owner Cost |

7,500.00 |

6,250.00 |

5,000.00 |

3,750.00 |

2,500.00 |

25,000.00 |

|

Net Profit |

442,500.00 |

368,750.00 |

295,000.00 |

221,250.00 |

147,500.00 |

1,475,000.00 |

Next the Net Profit for each Partner is divided between the Partner's Employer Contribution, the Partner's Social Security Tax and the Partner's Compensation.

The Social Security Tax is 1.45% of the Net Profit (reduced for the Social Security Tax) plus 6.2% of the Net Profit (reduced for the Social Security Tax) up to the Taxable Wage Base.

The formula reduces the Net Profit for the Social Security Tax by multiplying by 0.9235.

See the chart below showing the calculation of the Social Security Tax based on the 2023 Taxable Wage Base of $160,200.

|

Net Profit |

442,500.00 |

368,750.00 |

295,000.00 |

221,250.00 |

147,500.00 |

1,475,000.00 |

|

Reduced by 0.9235 |

408,648.75 |

340,540.63 |

272,432.50 |

204,324.38 |

136,216.25 |

1,362,162.50 |

|

1.45% |

5,925.41 |

4,937.84 |

3,950.27 |

2,962.70 |

1,975.14 |

19,751.36 |

|

6.2% up to $160,200 |

9,932.40 |

9,932.40 |

9,932.40 |

9,932.40 |

8,445.41 |

48,175.01 |

|

Social Security Tax |

15,857.81 |

14,870.24 |

13,882.67 |

12,895.10 |

10,420.54 |

67,926.36 |

Finally, Net Profit reduced by the Social Security Tax must be divided between the Partner's Employer Contribution and the Partner's Compensation.

See the chart below which is based on Employer Contributions of a Cash Balance allocation of 100% of compensation and a Profit Sharing allocation of 6% of compensation.

Net Profit reduced by SS Tax |

426,642.19 |

353,879.76 |

281,117.33 |

208,354.90 |

137,079.46 |

1,407,073.64 |

Cash Balance Allocation (100%) |

207,107.85 |

171,786.28 |

136,464.72 |

101,143.15 |

66,543.42 |

683,045.42 |

Profit Sharing Allocation (6%) |

12,426.47 |

10,307.18 |

8,187.88 |

6,068.59 |

3,992.61 |

40,982.73 |

Total Employer Contribution |

219,534.32 |

182,093.46 |

144,652.60 |

107,211.74 |

70,536.03 |

724,028.15 |

Owner Compensation |

207,107.85 |

171,786.28 |

136,464.72 |

101,143.15 |

66,543.42 |

683,045.42 |

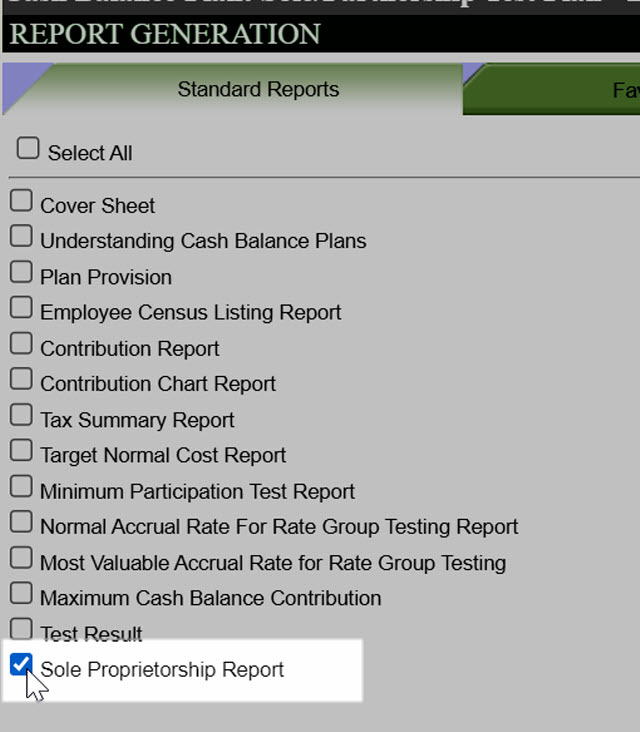

A new report has been added which displays the results of all these calculations.

From the Report Menu, select the "Sole Proprietorship Report".