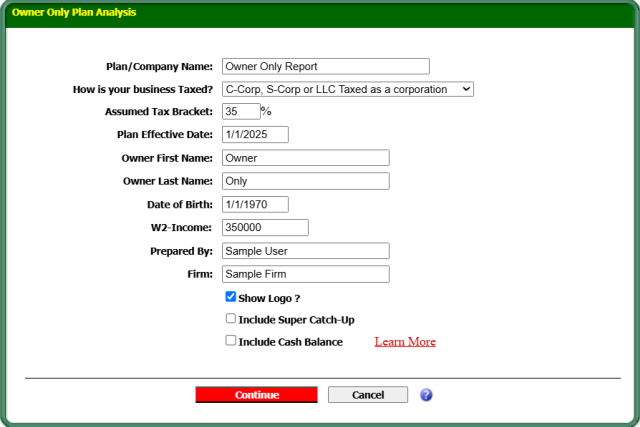

Owner Only Plan Analysis

Plan/Company Name:

The Company's Name can be as long as 75 characters.

How is your business taxed?

Your client is either taxed as a Corporation wherein owners (stockholders) are paid wages that are reported on W-2s or as an unincorporated business wherein all owners have Schedule C or K-1 incomes.

This tax bracket is used to estimate the after tax cost of the plan.

Plan Effective Date:

The Plan Effective Date is always the beginning of the Plan Year. Ages are calculated as of this date. However, all contributions are determined as of the end of the Plan Year.

Owner First Name:

Enter the owner's first name.

Owner Last Name:

Enter the owner's last name.

Date of Birth:

Enter the owner's date of birth.

W2 - Income:

Enter the amount that will be used as W2-Income for a Regular Corporation and Schedule C Income for a Sole Proprietorship.

Enter the name who prepared the report.

Enter the name of the company.

Show logo?

Check this option to include your report logo to this plan.

Check this option to increase the current Catch-Up limit by 150% for eligible participants aged between 60 to 63 years old.

This check-box is used to include Cash Balance calculations in the Owner Only report.

When you clicked this check-box, the 2 options "Exclude 401(k)" and "Exclude Profit Sharing" will be displayed automatically.