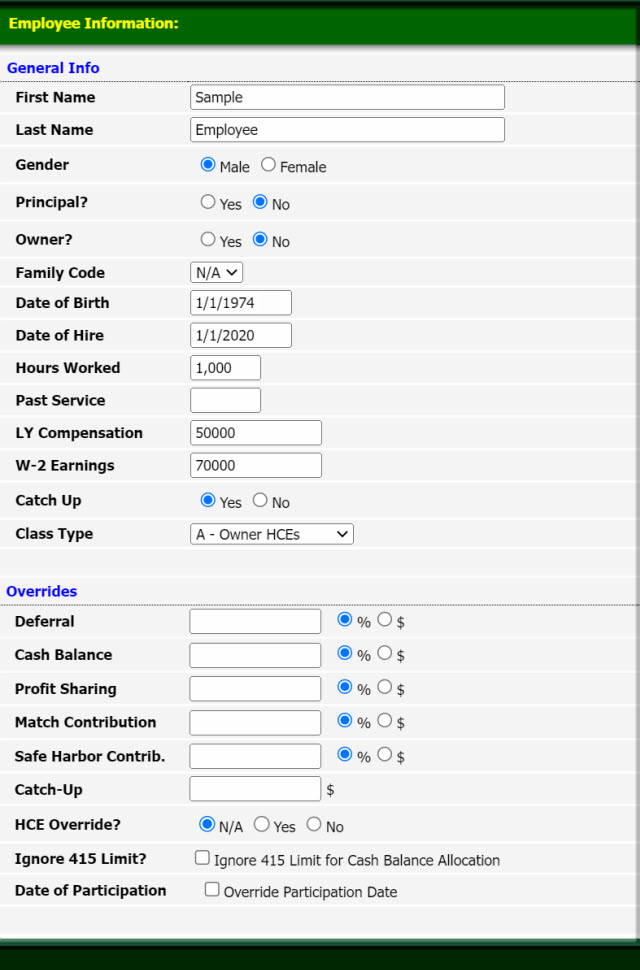

Employee Information

First Name:

The first name of the employee. Enter up to 40 characters.

Last Name:

The last name of the employee. Enter up to 40 characters.

Gender:

The gender (Male or Female) of the employee.

Principal:

For reporting purposes, there are two groups: Principals and Non-principals and costs are aggregated and compared against each other. By default all Owners are Principals. You may assign any employee to the Principal group. An HCE who is one because of his relationship to a 5% owner is not a principal by default.

Owner ?:

5% or more owners are Highly Compensated Employees (HCE). For New Comparability, three Classes are defined by default: Class A = Owners, Class B = Non-Owner NHCEs and Class C = Non-owners HCEs. These classes may be modified. You may change the description from to anything you want to call the classes. You may add as many classes as you want. Learn more on Classes.

Family Code:

This code is used to determine the relationships between 5% owners. Assign a common letter among employees belonging to the same family member. This is used only for purposes of determining who is an HCE since family attribution with regards to ownership applies to the definition of an HCE. e.g. Mr. Smith (a 5% owner) & Mrs. Smith and their son Jr. all belong to Family Code "A" while Mr. Smith's brother, Brother Smith, and his wife Jane does not belong to Family Code "A" but if he is also an owner, they may be in Family Code "B".

Date of Birth:

The following formats are acceptable and will result in the date = 01/01/1946: (1)1/1/46; (2)1/1/1946; (3)1/1946; (4)01/01/46; (Date of Birth cannot be after <% = Request.Cookies("minDOB")%> or before 1/1/1927.)

Date of Hire:

The following formats are acceptable and will result in the date = 01/01/2002:

(1)1/1/02; (2)1/1/2002; (3)1/2002; (4)01/01/02; Hire Date cannot be greater than 12 mos. after the Plan Effective Date. For DB Plans, past service when used in the benefit formula will be limited to five years regardless of Hire Date.

Hours Worked:

Hours worked this year. The default is 1,000 hours. This will be used only if you selected "Hours required" in the eligibility section of the Plan Detail.

Past Service:

The employee's past service.

LY (Last Year's) Compensation:

This compensation will be used to determine HCE status if provided. If left blank, the current year's compensation will be used.

W-2 Earnings:

Enter annual W-2 Compensation for all employees. Owner's compensation for Sole-proprietorships and Partnerships will not be entered here. Instead, it will be calculated from the Total Net Earnings entered in the Plan Specifications and based on the owner's percent ownership. Acceptable formats are 100,000 or 100000.

Catch Up:

Determines whether or not the employee will elect to defer the maximum catch-up amount of $6,000 for 2015 and 2016. Note that this will only be used if the participant is 50 or older. The default is yes.

Class Type:

By default, when a new plan is setup, all owners are assigned to Class A (the 'owner' class), others are assigned to Class B (the 'Non-owner NHCE) class and all others are assigned to Class C the Non-Owner HCE class). Learn more on Classes.

Overrides

Deferral:

Deferral amount or percent applicable to the employee. The deferral percentage in the Plan Specification will only be used if this field were left blank. This value will be a percent or a dollar amount depending on the selection of the option: ()% or ()$.

Cash Balance

Cash Balance amount or percent applicable to the employee. The cash balance override will be used for Cash Balance calculations instead of the value defined in the Class page. This value will be a percent or a dollar amount depending on the selection of the option: ()% or ()$.

Profit Sharing:

Profit Sharing amount or percent applicable to the employee. The census override will be used for Profit Sharing calculations instead of the value defined in the Class page. This value will be a percent or a dollar amount depending on the selection of the option: ()% or ()$.

Match Contribution:

Match Contribution amount or percent applicable to the employee. The match contribution override will be used for Match Contribution calculations. This value will be a percent or a dollar amount depending on the selection of the option: ()% or ()$.

Safe Harbor Contribution:

Safe Harbor Contribution amount or percent applicable to the employee. The safe harbor contribution override will be used for Safe Harbor Contribution calculations. This value will be a percent or a dollar amount depending on the selection of the option: ()% or ()$.

Catch-Up:

Catch-up amount applicable to the employee. The catch up override will be used for Catch-Up Contribution calculations.

HCE Override:

The program will automatically determine who are Highly Compensated Employees based on their ownership percentage (5% or more means they are) or based on their compensation ($90,000 or more). The rules for determining HCE however is more complex than that. Family attribution with regards to ownership may apply and if he is an HCE last year, he is HCE this year. A top 20% Highest Paid Rule may also be used. This override should be used to take care of those situations when the employee is considered to be an HCE whether or not they are 5% owner or earning less than $90,000.

Ignore 415 Limit?

Check this option to ignore the 415 Limit for Cash Balance Allocation in the report.

Date of Participation:

The day the employee is eligible to join the Plan. The date will be calculated based on the eligibility requirements entered in the Plan Specifications section. The user can override this field.

Related Topics

▪Adding, Editing and Deleting an Employee Record