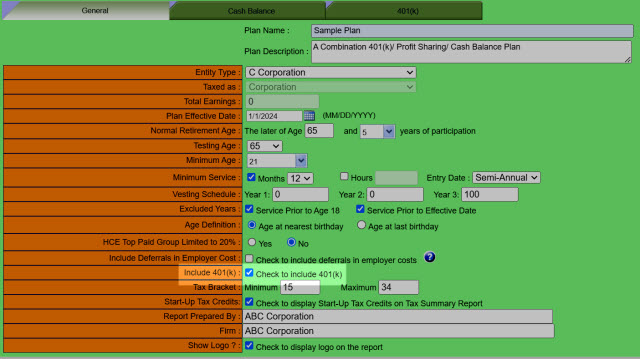

401(k)

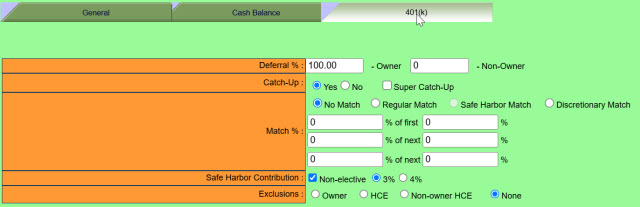

1.The 401(k) tab will only be available if the "Check to include 401(k)" option is checked in the General Tab.

2.Review or make changes to any 401(k) details.

3.The Safe Harbor Match and Safe Harbor Contribution - Non-elective (3% or 4%) options are mutually exclusive, meaning that each will only be available if the other is not selected.

4.You must click on the ![]() button to apply changes before leaving the page.

button to apply changes before leaving the page.

Deferral %:

This the expected percentage the owner(s) and the other employees will defer. You may override specific employees using the Census button and placing an appropriate dollar or percentage in the deferral column.

Catch-Up:

These contributions are an option that employers can provide. Participants who are age 50 and older or who will attain age 50 by the end of the calendar year are eligible to make catch-up contributions provided they exceed any of the applicable limits. The limits include the annual elective deferral limit ($24,500 in 2026), section 415 annual additions limit ($72,000 for 2026), any employer mandated limit, or an ADP test limitation.

Choosing Yes or No will set the catch-up provision for all participants who are eligible. User Defined allows the user to specify which participants will take advantage of the provision in the census.

Super Catch-Up option will increase the current Catch-Up limit by 150% for eligible participants aged between 60 to 63 years old.

Match %:

This is the matching formula applicable to the Plan. Regular Match indicates a mandatory match as required by the plan. Select the safe-harbor option to automatically enter the default safe-harbor formula. Select the discretionary match option to enter any formula up to 3 levels deep.

Safe Harbor Contribution:

This option enables you to select the 3% or 4% Non-Elective contribution instead of a safe-harbor match.

Exclusions:

This is used to exclude the selected option from the report calculations.