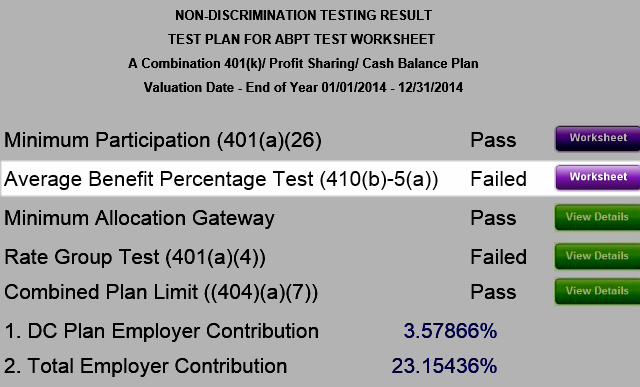

Average Benefit Percentage Worksheet Report

ABPT Worksheet Overview

|

Average Benefit Percentage Test Worksheet is used to manipulate your test results (to make it PASS) using Profit Sharing and Deferral Overrides. These changes can be seen in a single Worksheet page. It can also be used to solve the Minimum Profit Sharing Contributions for the NHCEs. |

|

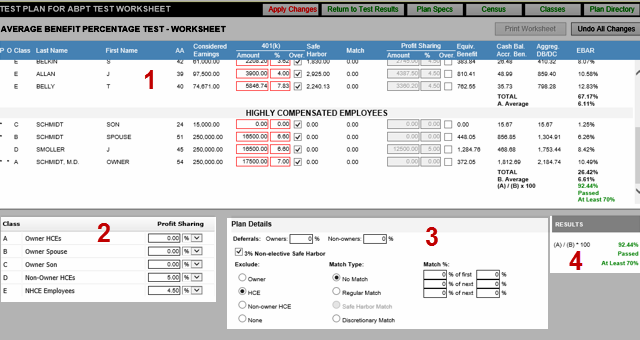

1.ABPT Report Details Section - This section provides interface to manipulate the individual defined contribution overrides. 401(k) and Profit Sharing override values are the same values defined in Employees Census Screen as Deferral and Profit Sharing Overrides respectively. |

|

Checking the

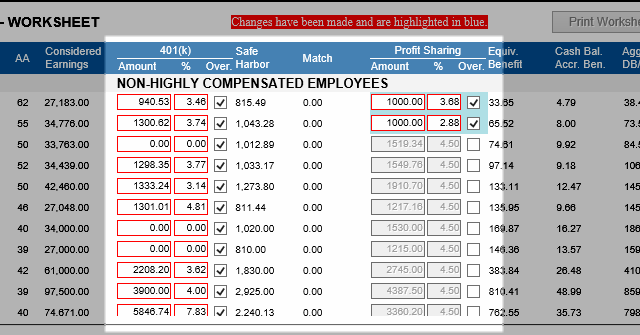

You can only modify on 401(k) and Profit Sharing columns (as shown above). The participant/s with override/s will be marked with RED border/s. Any override changes made through the worksheet will be highlighted in BLUE. However, once “Apply Changes” button is clicked, the blue highlight will go away and will only retain red border for saved overrides.

Note that whenever you make a change in the Amount ($) or Percentage (%) it will be automatically re-calculate and it will display the new ABPT result. |

|

2.Class Section – these are the same values defined in the Classes page containing Profit Sharing Amount ($) or Percentage (%).

3.Plan Details Section – these are the same values defined from Plan Specifications under 401(k) tab containing Deferrals, Safe Harbor and Match results.

NOTE: Unchecking the 401(k) checkbox from the Plan Details tab will disable the 401(k) columns. Every change on the values in the Class and Plan Detail Sections will re-calculate the results.

4.Results Section – this section displays the percentage and testing result of the ABP test. ABPT is computed as the Average EBAR of the NHCEs divided by the Average EBAR of the HCEs [(A) / (B)*100] and if the ABPT result is greater than or equal to 70.00 % it will display PASS. Otherwise, it will display FAIL.

IMPORTANT REMINDER: Make sure to click on the “Apply Changes” button to save and apply the changes permanently. |

Buttons:

|